the Subbie Tax App saves you money!

A quick and easy way to handle all your payslips, receipts, mileage and HMRC letters. The average Subbie Tax refund is between £2000 and £4000.

- Quick and easy to use

- Submit receipts, mileage and income

- Expert advice from qualified accountants

- Average Subbie Tax refund £2k - £4k

- Designed for Sub Contractors

- Personally assigned accountant

- Chat feature to speak to accountant anytime

- 1000+ Downloads

- 5 Stars Rating

What Subbie Tax can do for you

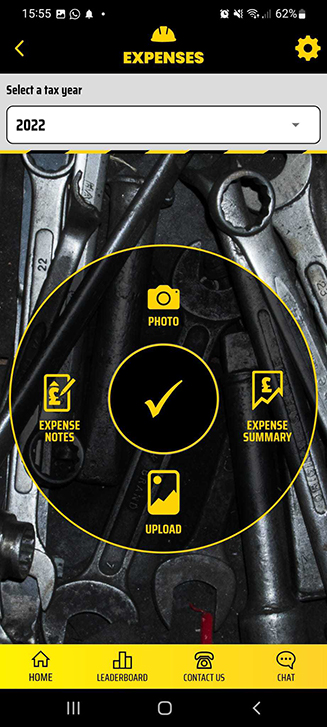

Expenses

Take photos of your receipts or complete your expenses with user-friendly expenses summary sheet.

Mileage

Fill in a record of a journey, add notes and submit. Log regular journeys to make it even easier to add frequent trips.

Income

Take and upload pictures, add notes or create as many manual entries as you need. They can be weekly, monthly or annually – it’s up to you.

Accounts

Take photos of letters from HMRC, or see letters we’ve received on your behalf, and be notified of anything you need to action.

Advantages of using Subbie Tax

- Only £199 with no upfront cost

- Avoid penalties for late submission

- Typical refund £2-£4k

- Assigned own personal accountant

- Subbie Tax discuss accounts before submission

- Personal, expert advice from qualified accountants

- Referral Leader Board

- Chat to one of our advisors through the app chat function

Happy Clients,

Great Reviews

Learn about Subbie Tax from other users and start streamlining your business today

Brilliant! Such an easy app to use! Love it! Fast response from the accounting team, everything I need in one app. Highly recommend to all Sub-contractors.

Marek Kowalkowski

I was assigned my own personal tax adviser, it was so quick and easy! The experience was completely personalised for me and there wasn’t even an upfront payment required. I would recommend to anybody!!

Matt Wilsons

Really simple app, great for my tax returns. Same sort of price as my accountant but easier to do it this way.

Phelix Plush

Blog

What You Need To Know About HMRC Tax Refunds

Tax refunds are often seen as a daunting subject, but they don’t have to be. If you’ve overpaid on your taxes or qualify for certain

Sub-Contractor Tax Deductions Explained

Navigating tax deductions as a self-employed sub-contractor can be challenging, but understanding what expenses you can claim can make a significant difference to your tax

From Bricks to Books – A Mini FAQ for Construction Financial Management

Financial management for your construction company can be as complex as the projects themselves. From budgeting for materials and labour to planning for taxes and

UK Cities with High Earnings for Subcontractors and How to Maximise Your Earnings

The UK construction industry thrives on the dedication and skill of its subcontractors. From bricklayers building the foundations to electricians bringing buildings to life, subbies

National Insurance Contributions for Sub-Contractors Explained

As a self-employed sub-contractor, understanding National Insurance Contributions (NICs) is essential to manage your finances effectively. In the UK, NICs are a form of tax

Top Tips for An Easy Tax Return

Completing a tax return can be a daunting task, especially for self-employed individuals and sub-contractors. However, the process can be made significantly easier with some